On www.shiburn.io anyone can burn $SHIBOO, but besides winning prizes and rewards for burning, how does the actual mechanism of burning a cryptocurrency work?

Burning a coin/token is not really a new concept, stocks do it too in the form of ‘buybacks’. The key and basic idea behind this concept is to take coins/tokens/shares out of circulation. Although burning a coin doesn’t increase its price directly or immediately, it does reduce its supply which automatically increases demand.

A Simple and Short Example of Burning a Cryptocurrency

Let’s use $Apples as an example. These are the features and stats of $Apples:

- Current Supply: 100

- Current Price: $1

- Market Cap: $1 x 100 = $100

Now, let’s imagine we burn 10 apples, reducing its supply to only 90. The price will still be $1, however, the market cap will now be $1 x 90 = 90$. So right now it seems like the only thing we did is to reduce the mcap of Apples from $100 to 90$ without changing the price.

This can be a good thing as traders and holders want to invest in good projects that have lower market caps. However, an additional and more direct benefit of this burn was the reduction in supply.

Let’s say there are 80 people that want to buy 1 apple each. Now burn 30 apples, reducing its supply to only 70. Not everyone that holds apples wants to sell them, usually you can see 10-30% of the supply of a coin on Exchanges.

Now, 80 people are trying to buy 80 apples, but there are only 70 apples available and most of those apples are not even on sale. The problem now is that they will fight between each other, bidding a higher price for each apple until the price becomes so high that people that didn’t want to sell apples previously, now are enticed to.

For an investor, this could look like this:

- Buys 10 Apples at $1 each, spending a total of $10

- The Initial Market Cap when the investor bought was $100 (100 Apples x $1)

- Apples get burned, 50 apples are now gone, the price is still $1.

- Now the mcap is $50, but the price is still $1.

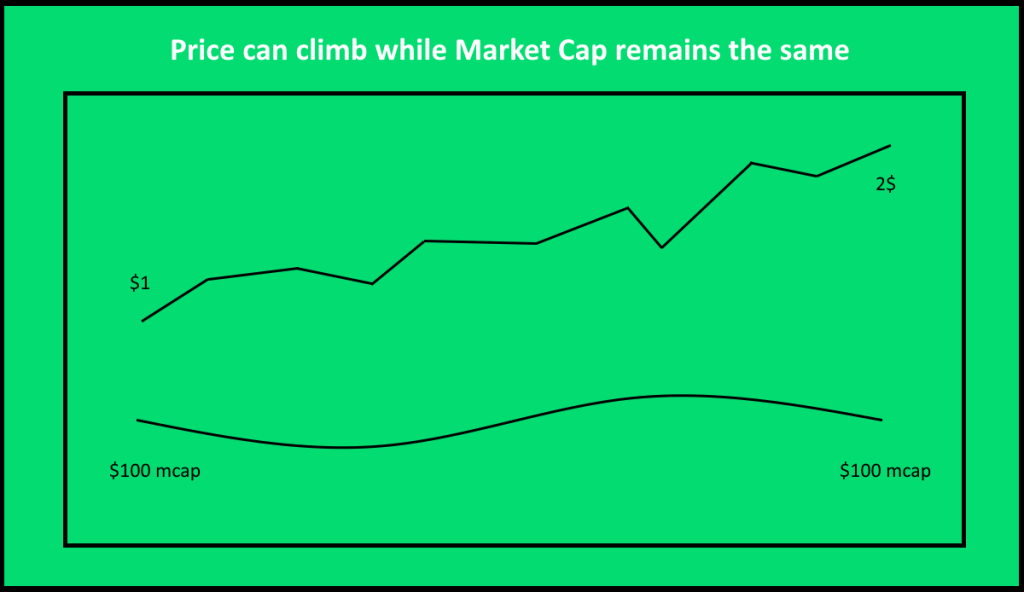

For the investor, the price is still $1, so if he wants to sell, he will still be able to sell at the same price. However, for new investors, the market cap is lower and they are more likely to buy. Now a lot of people starts buying Apples and the price goes to $2.

The mcap is now $100 again but the price is $2. The initial investor has 2x his initial investment but the mcap is still $100 so the potential of the coin to go higher is actually still the same, essentially meaning that the investor bought at $0.5 per apple instead of $1.

We hope this brief explanation of how burning a cryptocurrency could impact its price and market cap has been useful! Remember to keep stacking SHIBOO!